9 Simple Techniques For Kam Financial & Realty, Inc.

Table of ContentsKam Financial & Realty, Inc. - TruthsFascination About Kam Financial & Realty, Inc.A Biased View of Kam Financial & Realty, Inc.The Ultimate Guide To Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. - The FactsNot known Incorrect Statements About Kam Financial & Realty, Inc.

A mortgage is a finance used to purchase or maintain a home, plot of land, or other real estate.Home loan applications undergo a strenuous underwriting process before they reach the closing phase. Mortgage types, such as conventional or fixed-rate car loans, vary based upon the borrower's requirements. Home mortgages are lendings that are utilized to acquire homes and other sorts of real estate. The residential or commercial property itself functions as security for the financing.

The expense of a home mortgage will certainly depend on the kind of lending, the term (such as three decades), and the rates of interest that the lender charges. Home loan prices can vary extensively depending on the type of product and the credentials of the candidate. Zoe Hansen/ Investopedia People and services utilize mortgages to copyright estate without paying the whole acquisition cost upfront.

Not known Details About Kam Financial & Realty, Inc.

The majority of conventional mortgages are completely amortized. Regular home loan terms are for 15 or 30 years.

A residential property buyer pledges their house to their loan provider, which then has an insurance claim on the residential or commercial property. In the situation of repossession, the loan provider might force out the citizens, market the home, and utilize the money from the sale to pay off the mortgage debt.

The lender will ask for evidence that the consumer is capable of settling the loan. (http://peterjackson.mee.nu/where_i_work#c2460)., and proof of existing employment. If the application is accepted, the loan provider will provide the borrower a funding of up to a specific quantity and at a specific passion price.

The 9-Second Trick For Kam Financial & Realty, Inc.

Being pre-approved for a mortgage can provide purchasers an edge in a tight real estate market due to the fact that vendors will understand that they have the cash to back up their deal. When a customer and vendor concur on the regards to their bargain, they or their reps will meet at what's called a closing.

The vendor will transfer ownership of the residential property to the buyer and obtain the agreed-upon amount of money, and the customer will certainly sign any remaining home mortgage records. The lending institution might bill fees for coming from the financing (sometimes in the kind of points) at the closing. There are hundreds of alternatives on where you can obtain a home loan.

The Ultimate Guide To Kam Financial & Realty, Inc.

The basic kind of home loan is fixed-rate. With a fixed-rate home loan, the rates of interest remains the very same for the whole term of the finance, as do the customer's monthly repayments towards the home mortgage. A fixed-rate home loan is additionally called a conventional home loan. With an adjustable-rate home mortgage (ARM), the rate of interest is fixed for an initial term, after which it can change periodically based on prevailing rate of interest prices.

The Greatest Guide To Kam Financial & Realty, Inc.

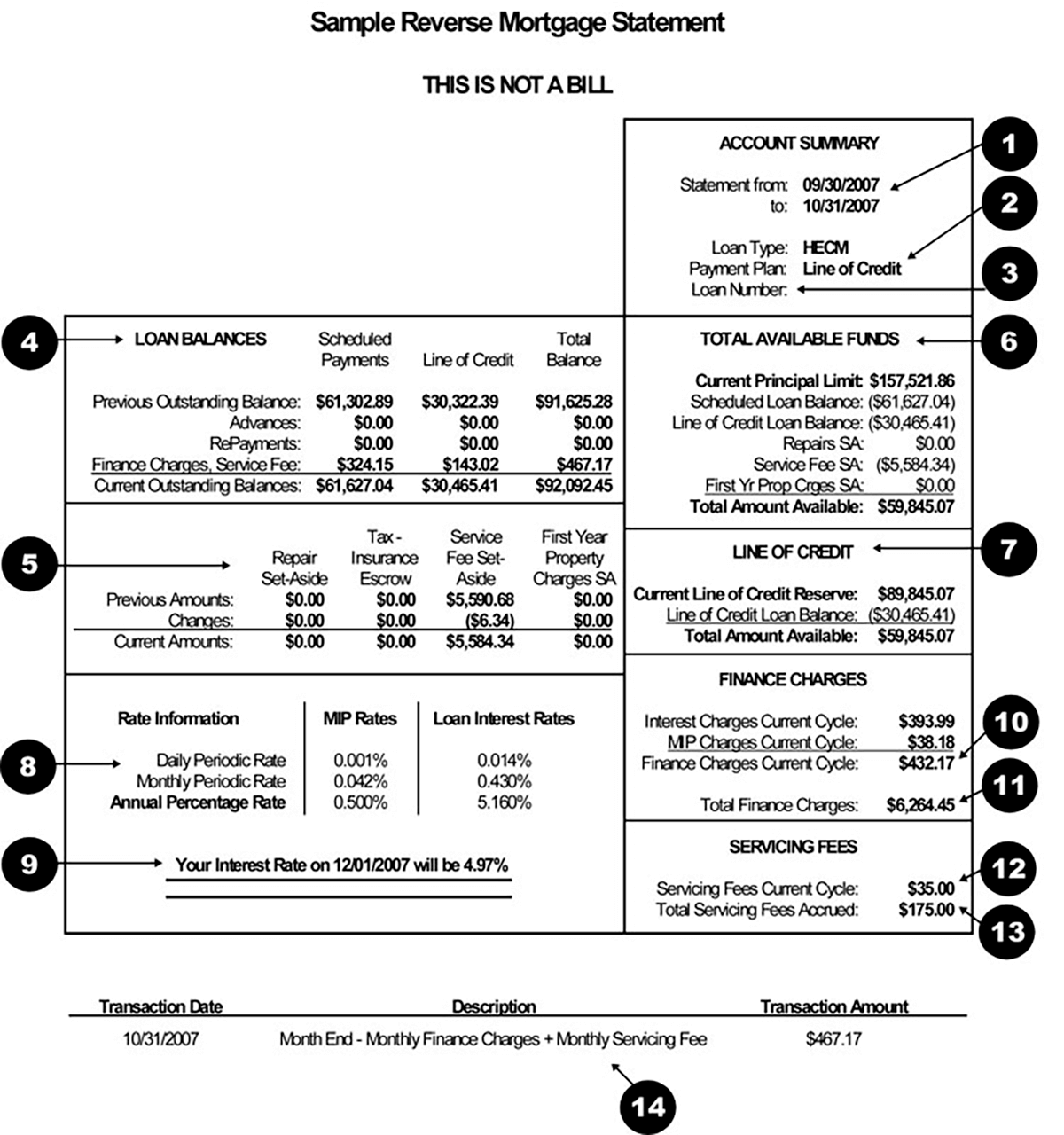

The entire financing balance ends up being due when the consumer passes away, relocates away completely, or sells the home. Points are basically a charge that debtors pay up front to have a reduced interest price over the life of their funding.

The 9-Minute Rule for Kam Financial & Realty, Inc.

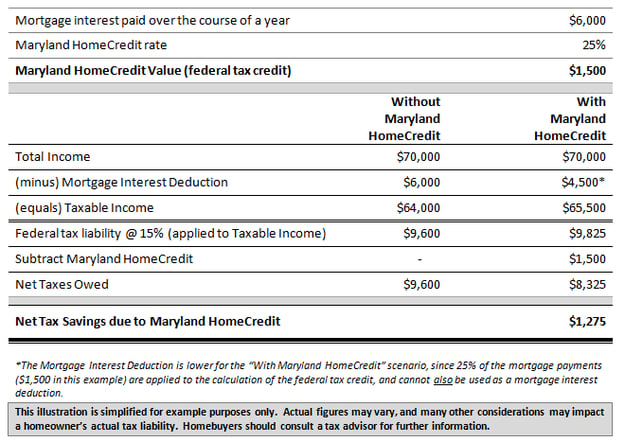

Just how much you'll have to spend for a mortgage depends upon the type (such as fixed or flexible), its term find out here (such as 20 or thirty years), any kind of discount factors paid, and the rate of interest at the time. california loan officer. Rate of interest can differ from week to week and from lender to lending institution, so it pays to search

If you default and confiscate on your mortgage, nonetheless, the bank may come to be the new proprietor of your home. The cost of a home is often much above the quantity of cash that most homes conserve. Therefore, home mortgages allow people and families to acquire a home by placing down just a fairly tiny down payment, such as 20% of the acquisition cost, and obtaining a funding for the balance.